Competency Triangle

If the director or owner of the company personally approves the payment invoices, he will not be able to break out of the routine. Of course, you need to make sure that the money is spent rationally. But making the right decision to pay the bill requires a very deep understanding of how much this acquisition is necessary.

Agree, a senior manager should not delve into all the nuances of the company. Otherwise, the company simply will not be able to grow, because sooner or later it will become a bottleneck in business processes. In order for the manager to do his job and use the money as efficiently as possible, a financial planning system is needed, in which the heads of departments play the main role in the distribution of money. If you want to know what is the bottleneck in your company today, take the organizational test.

Resource Required for Responsibility

Before talking directly about the distribution of money, it is worth considering another important point. Typically, senior management seeks to instill responsibility for the results of their activities with their subordinates. It is expected that the head of the advertising department will take responsibility for its effectiveness by providing the company with a sufficient number of customers, and the head of the production unit will help to fulfill orders.

But for a manager or employee to be able to really manage his area really well, he must have a clearly defined area of activity on the organizational chart and the ability to manage resources, make necessary acquisitions, make expenses, that is, to a certain extent manage money. If an employee is deprived of the opportunity to influence the company's expenses in the area entrusted to him, he essentially cannot get results. You can’t expect a computer technician to work without fail if he doesn’t have the opportunity to order the necessary parts and materials. If the head of the advertising department cannot promptly receive the payment of necessary bills for services, then advertising campaigns will stop.

When I wrote the book “Financial Planning. The art of creating income”- conducted a survey among entrepreneurs, and found that from the common practice of dealing with money, one can find the following:

- employees do not have the ability to quickly manage money, so they often do not receive on time what they need to work;

- they don’t know exactly what amounts they can expect, since they have no idea about the level of income and expenses of the company;

- taking the initiative to make some acquisitions, they feel like petitioners, and this creates a psychological problem, since capable people do not like this role.

All this leads to the fact that talking about the responsibility of employees for the results of activities is pointless, as a result, the leader alone is responsible for all the results, and the employees remain spectators.

Responsibility process

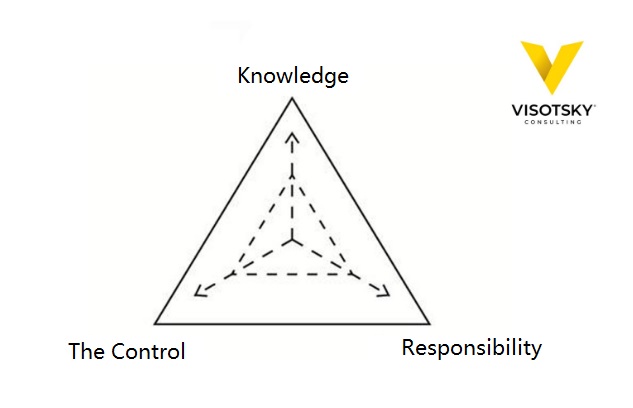

The formation of responsibility can be visualized in the form of a triangle of knowledge - responsibility - control, or as it is also called the "triangle of competence."

Building competency starts at the top of “knowledge.” In order for a person to be competent in relation to his work, he needs knowledge, information, information.

A competent seller knows the goods well, the basic methods of selling, how to work with documents, and also what are the results of the sale - in the end the customer paid or not.

The second peak of the triangle is “responsibility”. Responsibility at its core is a person’s decision about whether he will influence something or become a consequence of the influence. For example, the seller failed the transaction, the client refused to buy, and the moment of truth comes - the employee will either decide in this case that he was the culprit of the failure, or try to push it to someone else. In the first case, he will accept responsibility, in the second - he will refuse it. In the first case, he is likely to make an analysis of his actions, find a mistake, and in the second, his life will be haunted by “not such” clients.

The third peak is “control.” This word in Russian is usually understood as supervision. But in management, control is the ability to control an object, influence it and, of course, change its state. The seller can influence customers, communicate with them. If he does not have such an opportunity, then he simply will not need knowledge, and, despite his responsibility, there will be no results.

All three peaks are interconnected, it is impossible to raise one without raising the rest. In order for the seller’s competence to grow, he must gradually replenish his knowledge base. This will give him the opportunity to see what else he can influence in the sales process and then be able to raise the level of control. If one of the peaks collapses, all the others will collapse. You probably saw what happened to the seller after some evil client with foam at the mouth proved to him that he was a deceiver or the like. Often the seller loses confidence in his abilities, and this confidence is essentially the responsibility, he ceases to control the sales processes and even refuses knowledge, simply claiming that all this does not work.

Let's go back to finances and look at what is happening in the area of money management. We want every company leader to feel responsible for the total income and profit. From the point of view of the summit, “knowledge” requires that he know the state of affairs in finances. The head must have information about the income and expenses of the company, as well as the rules in accordance with which it can receive approval of the costs of its unit. In order for there to be “responsibility”, he must be sure that he can influence the distribution of money. And for him to have “control”, he needs to participate in their distribution. Only in the presence of these three components does competence appear, a responsible and careful attitude to money.

Imagine that you want to teach your child how to handle money wisely. To do this, you will first have to give him knowledge of money. Then he should have confidence that he can manage some amount. For this, smart parents usually come up with some kind of game in which the child receives money for the benefits brought for the family. This is how responsibility is formed - he gradually gains confidence that he can positively influence his own money. But it is also necessary to give the child the opportunity to spend them, that is, “control”. At the same time, he will make mistakes at first, but with time he can become competent in this matter.

The formation of the competence and responsibility of managers in relation to company expenses occurs in a similar way. The first thing to do is to establish accurate and understandable rules for managing money, which state how much the company owes or has the right to spend on different items of expenditure. These rules are formed on the basis of the long-term budget and existing expense items. They usually set the amount of mandatory deductions for wages, dividends, reserves and other items of expenditure. This all works with reasonably implemented and working management tools. My company helps owners implement tools in 12 months as part of the Business Owner School project. Some owners manage to implement it on their own, but it takes longer, with large losses of employees and more expensive financially.

After the rules are formed, it is necessary to transfer the work of distributing money to the board of directors. In Vysotsky Consulting, a council is built upon the introduction of an organizational chart at a workshop or BOS. Their task is, within the framework of existing rules, to distribute the money received by the company for the week in such a way that, firstly, it complies with the established rules, and secondly, they are rationally spent and bring it even more income.

The role of the board of directors

Any expense incurred by the company should be considered as an investment in its activities, which should give a certain return. To do this, on the board of leaders you need:

- consider data on the company's income and expenses for the week, compare the results with the implementation of previously approved plans;

- coordinate unit plans for the next week, comparing with previous ones, to develop a common agreed plan. In the process of this coordination, managers will develop a common point of view on priorities, which will allow them to make the right decisions in the process of allocating funds. After all, money should be used so that the maximum return is received;

- discuss applications for each of the units and, comparing them with plans, make decisions about which of them and in what volume to approve.

As a result of the activities of the board of directors, a proposal is made for the distribution of funds for the week, which, of course, must be approved by senior management before it becomes the basis for paying bills.

Thus, the management spends only a few minutes on a weekly basis, after this advice has done its work, to consider the proposal for the allocation of funds and to approve or amend it.

The weekly distribution of funds forces managers to plan the activities of their units, to prepare in advance applications for payments, which must be approved by the council. You can read more about the financial planning system in my book “Financial Planning. The art of creating income. ” And the need to defend their applications makes them responsibly approach to their preparation. Since the council only distributes income actually received during the week, the size of which is always limited, you have to choose which applications to satisfy in the first place, to prove the effectiveness of certain costs. These disputes cannot come to a standstill if there are pre-agreed plans for the activities of the units, because in fact, by the time the money is allocated, the priorities are already defined in the plans.

When ten years ago I introduced a similar approach in one of my companies, I was amazed at how quickly the point of view and level of responsibility of managers can change. The production manager, who previously claimed that he can only produce products for 60 thousand UAH. a week, just a few weeks after the time when the board of managers started working on this model, he demanded orders of at least 80 thousand and a gradual increase to 120. Before that, he only complained about poor equipment and outdated equipment, and when he really realized financial situation, then figured out how to raise without significant production costs almost doubled. This is a practical example of management tools that can work in your business. Learn more about the School of Business Owners, and if you are ready, we will strengthen you and your company.

Good luck!